Professional Bookkeeping & Accounting Services You Can Depend On

At Xceed Accountants, we take pride in providing exceptional accounting and financial advisory services tailored to the unique needs of our clients. Entrust your financial well-being to our team of experienced and dedicated professionals.

Trusted Bookkeeping & Accounting Solutions

👋 Hi, I’m Lee Wood, the founder of Xceed Accountants. With over 10 years of experience in finance, management, and business operations, I’m here to help small businesses stay on top of their finances with reliable, professional, and stress-free bookkeeping and accounting services.

My Background & Qualifications

📌 AAT Level 3 Qualified – Licensed Bookkeeper (currently working towards AAT Level 4)

📌 Over 10 years of experience in financial management, bookkeeping, and business strategy

📌 Former Head of Finance, overseeing financial operations across multiple locations

📌 10 years of experience running my own business, providing valuable insight into the challenges faced by business owners

📌 Former Audit Accountant, with hands-on experience working in practice with hundreds of businesses

Why Work With Me?

✅ Personalized Service – I take the time to understand your unique business needs, providing tailored solutions.

✅ No Hidden Fees – Enjoy clear, transparent pricing with no surprises.

✅ Flexible & Friendly – Whether you’re a sole trader, partnership, or small business, I’ll simplify your finances, allowing you to focus on growth.

✅ Business Growth Focus – Beyond bookkeeping and accounting, I offer expert advice to help you boost cash flow, increase profitability, and achieve long-term success.

📞 Let’s chat about how I can help your business!

📞 07958456486 | 📧 [email protected] | 📍 Lincolnshire, Nottinghamshire & Derbyshire

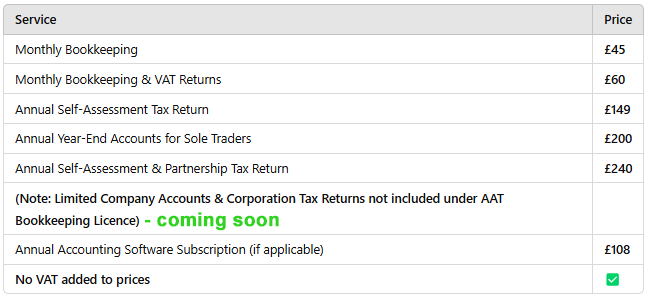

Bookkeeping Prices

Prices from

Bookkeeping services

Bookkeeping Services

Whether you’re a sole trader, partnership, or limited company, I’ll take care of your bookkeeping so you can focus on what matters most—growing your business. From VAT returns and Making Tax Digital compliance to cash flow management, credit control, and detailed reporting, I handle the numbers so you don’t have to.

Accounting Software Solutions

Say goodbye to paperwork and hello to efficiency. With cloud-based accounting software, you can securely store and access your financial data anytime, anywhere. Capture receipts, send quotes and invoices on the go, track up-to-date profits, and stay compliant with Making Tax Digital. I can help you choose the right software, set it up, and manage it. Whether it’s QuickBooks, Xero, FreeAgent, Sage, or others, I’ve got you covered.

Self-Assessment Tax Returns

They say tax doesn’t have to be taxing, but it often feels that way. Let me take the stress out of your self-assessment tax return. With your details, I’ll handle the filing with HM Revenue & Customs (HMRC), ensuring you don’t miss any allowances or reliefs you’re entitled to.

VAT Returns

VAT returns can be a headache, but I can simplify the process for you. I’ll ensure your VAT returns are completed accurately and submitted on time, helping you stay compliant while avoiding costly penalties.

Making Tax Digital (MTD)

Staying on top of Making Tax Digital requirements is crucial for your business, but it doesn’t have to be complicated. I’ll guide you through MTD, ensuring your records are compliant and your submissions are seamless.

Cash Flow Management

Understanding and managing cash flow is key to business success. I’ll help you track and optimize your cash flow, ensuring you have the financial insight needed to make informed decisions and maintain healthy finances.

Credit Control

Effective credit control ensures your business gets paid on time, every time. I’ll help you set up and manage a robust credit control system, improving your cash flow and reducing the risk of bad debts.

Financial Reporting

Accurate financial reporting is essential for making the right business decisions. I’ll provide you with clear, up-to-date financial reports that give you a complete picture of your business’s financial health.

Payroll Services

Managing payroll can be complex, but it’s crucial for business success. Our payroll services include processing payslips, calculating taxes and benefits, and ensuring compliance with employment laws and HMRC guidelines.

Want to find out more and get a quote?

If you would like further inforamtion about the services we offer and how our team can help you grow, get in touch with Xceed Accountants in Lincolnshire, Deryshire and Nottinghamshire, today – we are always happy to help.

Call us on 07958456486 or click below to use the contact form

Accounting Services

(coming Soon)

Management Accounting

Management accounting helps you make informed business decisions by providing detailed financial insights. We’ll assist in budgeting, forecasting, and financial analysis, giving you a clear view of your financial performance and areas for improvement.

Financial Statements Preparation

Ensure your financial statements comply with industry standards and regulations. We’ll prepare your balance sheet, profit and loss statement, and cash flow statements to provide a comprehensive overview of your business’s financial health.

Year-End Accounts

Prepare for year-end with ease by having your accounts finalized and compliant. Our team will assist with finalizing your financial statements, making adjustments, and preparing your company for tax season.

Budgeting & Forecasting

Effective budgeting and forecasting are key to business growth. Our service will help you plan for future financial goals, estimate income and expenses, and analyze cash flow to ensure your business stays on track.

Tax Computations

We will provide precise tax calculations based on your financial data, ensuring you comply with tax laws and identify opportunities for savings. Let us take care of your tax liabilities with clear, accurate computations.

VAT Returns & Planning

Let us manage your VAT returns with accuracy, ensuring you’re compliant with all relevant regulations. We can also offer VAT planning to help reduce your tax burden and make the most of available exemptions.

- Advanced Bookkeeping

- Management Reporting for SMEs

- Audit Preparation

- Financial Reporting & Analysis

- Business Forecasting & Valuation

- Capital Allowances & Tax Relief

- Cash Flow Management

- Company Taxation